What is Bitcoin And How Does it Work?

Bitcoin is digital money that runs independently of any central authority or government monitoring. Peer-to-peer software and cryptography are used instead. a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible like NFT.

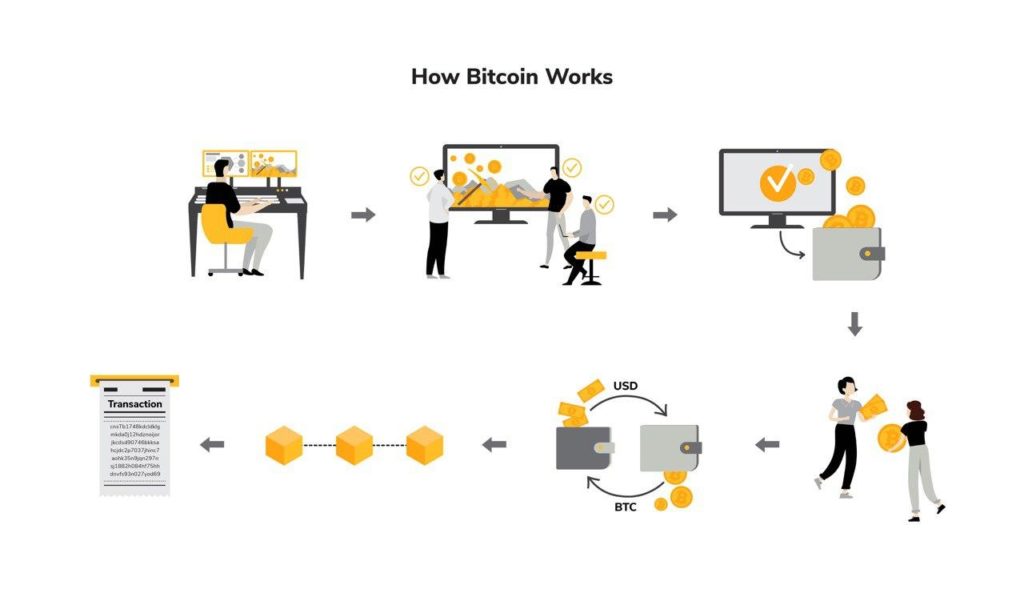

All bitcoin transactions are recorded in a public ledger, and copies are stored on servers all around the world. A node is a server that can be set up by anyone with a spare computer. Rather than relying on a central source of trust like a bank, consensus on who owns which coins is reached cryptographically among these nodes.

Every transaction is broadcast to the entire network and shared across nodes. Miners consolidate these transactions into a group known as a block and add them to the blockchain permanently every ten minutes or so. This is the definitive bitcoin account book.

Virtual currencies are stored in digital wallets, which can be accessed by client software or a variety of internet and hardware solutions, similar to how traditional coins are kept in physical wallets.

Bitcoins are now subdivided into seven decimal places: a milli is a thousandth of a bitcoin, and a satoshi is a hundred millionth of a bitcoin.

In reality, there is no such thing as a bitcoin or a wallet; rather, the network agrees on who owns a coin. When making a transaction, a private key is used to prove ownership of funds to the network. A "brain wallet" is a concept in which a person can simply memorize their private key and use it to retrieve or spend their virtual money.

What exactly is bitcoin's purpose?

Bitcoin was created as a means of transferring money over the internet. The goal of the digital currency was to create an alternative payment system that was free of central control and could be used in the same way as existing currencies.

Who is the inventor of bitcoin?

The.org domain name was purchased in 2008, and an academic white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System was uploaded. It outlined the theory and design of a digital currency system that is independent of any organization or government.

“The root problem with conventional currencies is all the trust that is required to make it work,” the author, who goes by the name Satoshi Nakamoto, wrote. The central bank must be trusted not to debase the currency, but fiat currencies have a long history of betraying that trust.”

The software described in the paper was completed and released publicly the following year, resulting in the launch of the bitcoin network on January 9, 2009.

Nakamoto continued to work on the project with a variety of developers until 2010 when he or she stepped away from it and left it to its own devices. Nakamoto's true identity has never been revealed, and he hasn't made any public statements in years.

Now that the software is open-source, anyone can view, use, and contribute to the code without charge. Many companies and organizations, including MIT, are working to improve the software.

Is it possible to exchange bitcoin for cash?

Bitcoin, like any other asset, may be exchanged for cash. People can do this on a variety of cryptocurrency exchanges online, but transactions can also be done in person or over any communications network, allowing even small enterprises to take bitcoin. Bitcoin does not have an official mechanism for converting to another currency.

The bitcoin network is supported by nothing fundamentally valuable. However, since exiting the gold standard, many of the world's most stable national currencies, such as the US dollar and the British pound, have become more stable.

What is bitcoin mining, and how does it work?

Mining is the process of keeping the bitcoin network up and running, as well as creating new currencies.

All transactions are broadcast to the entire network, and miners combine large groups of transactions into blocks by completing a cryptographic calculation that is extremely difficult to generate but very simple to verify. The first miner to solve the next block announces it to the network, and it is added to the blockchain if it is verified accurately. After that, the miner is rewarded with a portion of the newly created bitcoin.

A hard limit of 21 million coins is built into the bitcoin software. There will never be anything more than that. By 2140, the total quantity of coins in circulation will be reached. Every four years, the software doubles the difficulty of mining bitcoin by reducing the size of the rewards.

When bitcoin originally came out, it was feasible to mine a coin almost instantly using a simple computer. Mining now necessitates rooms full of powerful equipment, including high-end graphics cards capable of crunching through the calculations, which, when combined with a volatile bitcoin price, can make mining more expensive than it is worth.

Miners also choose which transactions to include in a block, so the sender adds fees of varying amounts as an incentive. These fees will continue to be charged after all coins have been mined as an incentive to continue mining. This is required because it serves as the Bitcoin network's infrastructure.

What are the drawbacks to using bitcoin?

There have been a number of criticisms of bitcoin, including the fact that the mining system consumes a lot of energy. The University of Cambridge has an online calculator that tracks energy consumption, and it was estimated that it used over 100 terawatt-hours annually at the start of 2021. To put things in perspective, the United Kingdom consumed 304 terawatt-hours in 2016.

Critics have linked cryptocurrency to criminality, claiming that it is a convenient way to conduct black market transactions. In reality, cash has served this purpose for centuries, and bitcoin's public ledger could be used by law enforcement.

Is bitcoin a safe investment?

Bitcoin's cryptography is based on the SHA-256 algorithm, which was developed by the US National Security Agency. For all intents and purposes, cracking this is impossible because there are more possible private keys to test (2256) than there are atoms in the universe (estimated to be somewhere between 1078 to 1082).

Although there have been some high-profile incidents of bitcoin exchanges being hacked and monies stolen, these firms almost always keep the digital currency on behalf of their consumers. The website, not the bitcoin network, was hacked in these situations.

On principle, if an attacker possessed more than 50% of all bitcoin nodes, they could form a consensus claiming they held all bitcoin and have it recorded in the blockchain. However, as the number of nodes increases, this becomes less feasible.

The fact that bitcoin functions without a central authority are a significant issue. As a result, anyone who makes a mistake with their wallet transaction has no redress. There is no one to turn to if you transmit bitcoins to the incorrect person or forget your password.

Of course, the arrival of practical quantum computing might derail everything. Many aspects of cryptography rely on mathematical computations that are extremely difficult for existing computers to perform, but quantum computers work in a different way and could complete them in a fraction of a second.

Related Posts

Tue, Feb 3, 2026 2:11 AM

Internet BundlesFiber Internet vs. Cable Internet: Which One Fits Your Home?

Compare fiber internet vs cable internet for speed, reliability, cost, and availability to find the best home internet option for your needs.

Tue, Feb 3, 2026 1:59 AM

Technology Broadband InstallationHow to Boost Satellite Internet Signal Fast and Easily

Satellite internet can be a good option for rural areas. But if you are having a slow internet connection, you can try this solution to boost satellite internet.

Fri, Jan 30, 2026 2:53 AM

Internet Bundles cheap internet offers cheap internet plansWhat’s New With Verizon: Plans, Speeds, and Network Updates

Explore the latest Verizon plans, pricing, and network updates, including wireless Unlimited plans, Fios fiber internet, and 5G home options.

Thu, Jan 29, 2026 5:53 AM

Internet BundlesXfinity Flex 4K Streaming Box: What You Get and Why It’s Worth It

Discover what Xfinity Flex offers, including free movies, 4K streaming, supported apps, pricing, and whether it’s worth it for Xfinity Internet users.

Wed, Jan 28, 2026 2:25 AM

Internet BundlesWhy Internet Speed Can Make or Break Your Business Growth

Fast, reliable internet is essential for business growth. Learn how internet speed impacts productivity, customer experience, and long-term success.